$7,500 Arkansas Notary Public Bond

$50.00

This $50 10-year $7,5000 Arkansas Notary Public Bond is required by the Arkansas Secretary of State in order to become a Arkansas notary public. To purchase this bond, please enter your Notary commission information and click Add to Cart.

- Description

- Additional information

- Arkansas Notary Bond Content

- Arkansas Notary E&O Content

Description

This $50 10-year, $7,500 Arkansas notary bond is issued from from an A.M. Best A rated insurance company. The notary must sign and file the notary bond with their county recorder. There are no refunds once a bond has been filed. Refunds may be granted if the bond is returned to our office.

The Arkansas notary public bond protects the public from mistakes made by the notary. If you make an error that results in harm to a third-party in connection with your duties as a notary, you may be liable up to the bond limit of $7,500. For this reason, many notaries purchase Notary Errors and Omissions (E&O) Insurance coverage. You may add E&O insurance by clicking the corresponding button.

Consult the Arkansas Secretary of State’s office for current forms, fees, and instructions: AR SOS Link www.sos.arkansas.gov

Additional information

| Surety Company | Travelers Surety, Western Surety Company |

|---|---|

| Bond Term | 10-year |

| Errors and Omissions (E&O) | Bond Only, $10,000, $15,000, $25,000, $50,000, $100,000 |

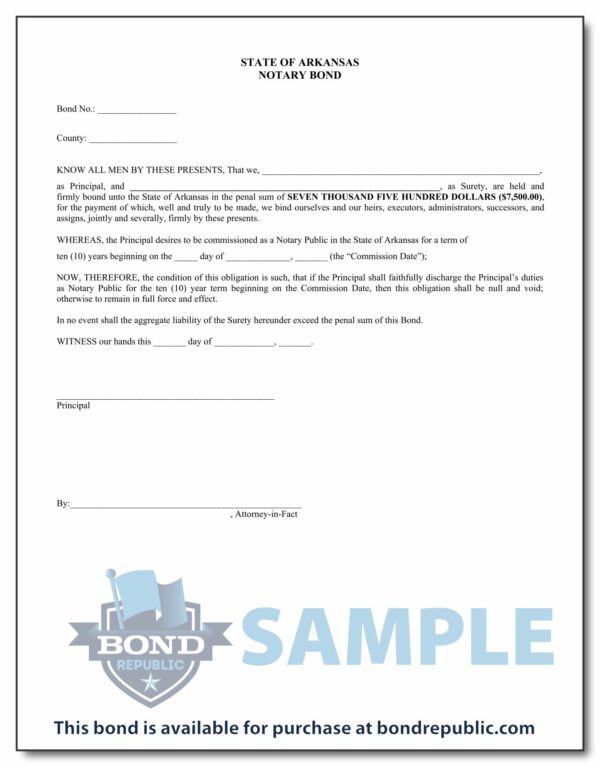

STATE OF ARKANSAS

NOTARY BOND

Bond No.: _________________

County: ___________________

KNOW ALL MEN BY THESE PRESENTS, That we, ____________________________________________________________,

as Principal, and ___________________________________________________________________, as Surety, are held and

firmly bound unto the State of Arkansas in the penal sum of SEVEN THOUSAND FIVE HUNDRED DOLLARS ($7,500.00),

for the payment of which, well and truly to be made, we bind ourselves and our heirs, executors, administrators, successors, and

assigns, jointly and severally, firmly by these presents.

WHEREAS, the Principal desires to be commissioned as a Notary Public in the State of Arkansas for a term of

ten (10) years beginning on the _____ day of ______________, _______ (the “Commission Date”);

NOW, THEREFORE, the condition of this obligation is such, that if the Principal shall faithfully discharge the Principal’s duties

as Notary Public for the ten (10) year term beginning on the Commission Date, then this obligation shall be null and void;

otherwise to remain in full force and effect.

In no event shall the aggregate liability of the Surety hereunder exceed the penal sum of this Bond.

WITNESS our hands this _______ day of _____________, _______.

_______________________________________________

Principal

By:__________________________________________________

, Attorney-in-Fact

Travelers Casualty and Surety Company

Travelers Casualty and Surety Company of America

One Tower Square, Hartford, Connecticut 06183

NOTARY PUBLIC ERRORS AND OMISSIONS POLICY

Policy No.

Term Premium:

Policy Effective Date:

The Company will pay on behalf of of

(the “Insured”), all sums which the Insured shall become

obligated to pay by reason of liability for breach of duty while acting as a duly commissioned and sworn Notary Public, claim for which is made

against the Insured by reason of any negligent act, error or omission, committed or alleged to have been committed by the Insured, arising out of the

performance of notarial service for others in the Insured’s capacity as a duly commissioned and sworn Notary Public.

POLICY PERIOD: This policy applies only to negligent acts, errors or omissions which occur during the Policy Period and then only if

claim, suit or other action arising therefrom is commenced within the applicable Statute of Limitations pertaining to the Insured. The Policy Period

commences on the Effective Date hereof and terminates upon the expiration of the Insured’s commission as a Notary Public unless cancelled earlier

as provided in this policy. This policy is not valid for more than one commission term.

LIMIT OF LIABILITY: The liability of the Company shall not exceed in the aggregate for all claims under this insurance the amount of:

$5,000 (Five Thousand) DOLLARS

$10,000 (Ten Thousand) DOLLARS

$15,000 (Fifteen Thousand) DOLLARS

$20,000 (Twenty Thousand) DOLLARS

$25,000 (Twenty Five Thousand) DOLLARS

$30,000 (Thirty Thousand) DOLLARS

In addition to the limit of liability and in accordance with the other provisions of this policy, the Company will pay costs and expenses paid and

incurred in investigating, contesting or settling liability in an amount not to exceed, in the aggregate, one-half of the limit of this policy.

INSURED’S DUTIES IN THE EVENT OF OCCURRENCE, CLAIM OR SUIT:

(a) Upon knowledge of any occurrence which may reasonably be expected to result in a claim or suit, written notice containing

particulars sufficient to identify the Insured and also reasonably obtainable information with respect to the time, place and circumstances thereof,

and the names and addresses of the potential claimant and of available witnesses, shall be given by or for the Insured to the Company or any of its

authorized agents as soon as practicable, but in no event longer than forty-five (45) days after discovery.

(b) If claim is made or suit is brought against the Insured, the Insured shall immediately forward to the Company every demand,

notice, summons or other process received by him or his representative.

(c) The Insured shall cooperate with the Company and, upon the Company’s request, assist in making settlements, in the conduct

of suits and the Insured shall attend hearings and trials and assist in securing and giving evidence and obtaining the attendance of witnesses. The

Insured shall not, except at his own cost, voluntarily make any payment, assume any obligation or incur any expense except with the prior written

consent of the Company.

EXCLUSIONS: Coverage under this policy does not apply to any dishonest, fraudulent, criminal or malicious act or omission of

the Insured.

OTHER INSURANCE: If the Insured has other insurance against a loss covered by this policy, the Company shall not be liable under this

policy for a greater proportion of such loss, cost and expenses than the limit of liability stated in this policy bears to the total limit of liability of all

valid and collectible insurance against such loss.

CANCELLATION: The insured may cancel this policy at any time by mailing or delivering to us advance written notice of cancellation.

The company may cancel this policy by mailing or delivering to the insured written notice of cancellation at least 10 days before the effective date of

cancellation if we cancel for nonpayment of premium or 30 days before the effective date of cancellation if we cancel for any other reason. If we

cancel, the premium refund will be pro rata and if the insured cancels, the refund may be less than pro rata. The cancellation will be effective even if

we have not made or offered a refund.

Dated, signed and sealed this .

By

Authorized Representative

E-1001A (01/05)

—————————————————–

ISSUED BY: POLICY NO:

ISSUED TO:

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

CANCELLATION/NONRENEWAL – ARKANSAS

FULL CANCELLATION – INSURER

It is agreed that:

1. The policy provisions regarding cancellation by the Company are deleted and replaced with the following:

A. CANCELLATION OF POLICIES IN EFFECT FOR 90 DAYS OR LESS

If this Policy has been in effect for 90 days or less and is not a renewal of a policy we issued, we may cancel this Policy

for any reason. We will mail or deliver written notice of cancellation to the entity named in Item 1 of the Declarations at

least:

(1) 10 days before the effective date of cancellation if we cancel for nonpayment of premium; or

(2) 20 days before the effective date of cancellation if we cancel for fraud or misrepresentation; or

(3) 30 days before the effective date of cancellation if we cancel for any other reason.

B. CANCELLATION OF POLICIES IN EFFECT FOR MORE THAN 90 DAYS

If this Policy has been in effect for more than 90 days, or is a renewal of a Policy we issued, we may cancel only for one

or more of the following reasons:

(a) Nonpayment of premium;

(b) Substantial change in the scale of risk covered by the policy;

(c) Fraud or material misrepresentation committed by the insured, upon the insurer;

(d) Failure to comply with reasonable safety recommendations; or

(e) Reinsurance of the risk associated with the policy has been cancelled.

We will mail or deliver written notice of cancellation under this item B., to the entity named in Item 1 of the

Declarations at least:

(1) 10 days before the effective date of cancellation if we cancel for nonpayment of premium; or

(2) 20 days before the effective date of cancellation if we cancel for fraud or material misrepresentation; or

(3) 45 days before the effective date of cancellation if we cancel for a reason described in B.(b), (d) or (e) above.

2. The following is added and supersedes any other provision to the contrary:

NONRENEWAL

A. If we decide not to renew this Policy, we will mail or deliver written notice of nonrenewal to the entity named in Item 1 of

the Declarations, at least 45 days before its expiration date, or its anniversary date if it is a Policy written for a term of more

than one year or with no fixed expiration date.

3. Proof of mailing is sufficient proof of notice.

Nothing herein contained shall be held to vary, alter, waive or extend any of the terms, conditions, exclusions or limitations of the

above mentioned policy, except as expressly stated herein. This endorsement is effective at the inception date stated in the

Declarations and this endorsement is part of such policy and incorporated therein.

ILT-5028 (06-04)

—————————————————–

ISSUED BY: POLICY NO:

ISSUED TO:

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

CANCELLATION/NONRENEWAL – ARKANSAS

CANCELLATION FOR NONPAYMENT OF PREMIUM

It is agreed that:

1. The policy provisions regarding cancellation by the Company are deleted and replaced with the following:

A. We may cancel this Policy for nonpayment of premium by mailing or delivering to the entity named in Item 1 of the

Declarations written notice of cancellation at least 10 days before the effective date of cancellation.

2. The following is added and supersedes any other provision to the contrary:

NONRENEWAL

A. If we decide not to renew this Policy, we will mail or deliver written notice of nonrenewal to the entity named in Item 1 of

the Declarations, at least 45 days before its expiration date, or its anniversary date if it is a Policy written for a term of more

than one year or with no fixed expiration date.

3. Proof of mailing is sufficient proof of notice.

Nothing herein contained shall be held to vary, alter, waive or extend any of the terms, conditions, exclusions or limitations of the

above mentioned policy, except as expressly stated herein. This endorsement is effective at the inception date stated in the

Declarations and this endorsement is part of such policy and incorporated therein.

ILT-5029 (06-04)