$5,000 California Tax Preparer Bond

$25.00 – $80.00Price range: $25.00 through $80.00

Required to work as a California tax preparer. $5,000 penalty amount. Bond terms of 1, 2, 3, 4, and 5 years available. 25% discounts built-in for multi-year purchase.

- Description

- Additional information

- Bond Content

Description

Required to work as a California tax preparer. $5,000 penalty amount. Bond terms of 1, 2, 3, 4, and 5 years available. 25% discounts built-in for multi-year purchase.

Additional information

| Weight | 2 oz |

|---|---|

| Dimensions | 11 × 8.5 × 0.1 in |

| Surety Company | Travelers Surety |

| Bond Term | 1-year, 2-year, 3-year, 4-year, 5-year |

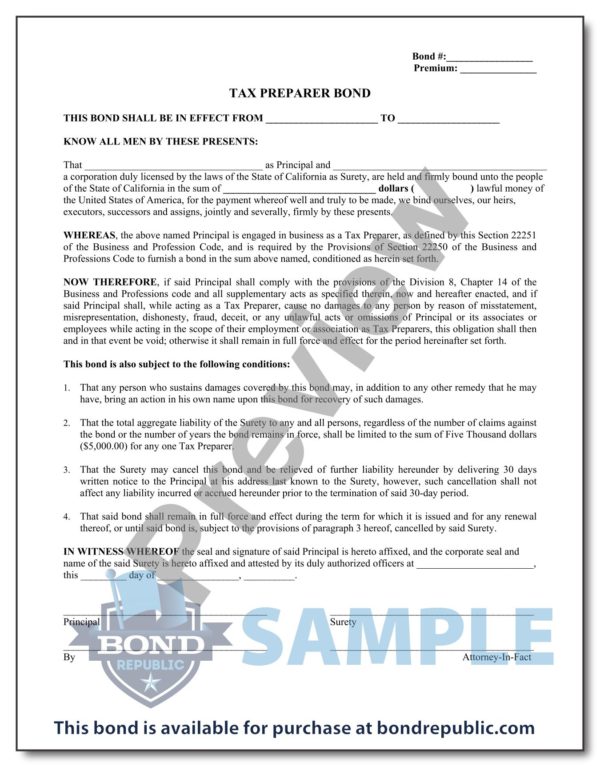

Bond #:_________________

Premium: _______________

TAX PREPARER BOND

THIS BOND SHALL BE IN EFFECT FROM ______________________ TO ____________________

KNOW ALL MEN BY THESE PRESENTS:

That ___________________________________ as Principal and __________________________________________

a corporation duly licensed by the laws of the State of California as Surety, are held and firmly bound unto the people

of the State of California in the sum of ______________________________ dollars ( ) lawful money of

the United States of America, for the payment whereof well and truly to be made, we bind ourselves, our heirs,

executors, successors and assigns, jointly and severally, firmly by these presents.

WHEREAS, the above named Principal is engaged in business as a Tax Preparer, as defined by this Section 22251

of the Business and Profession Code, and is required by the Provisions of Section 22250 of the Business and

Professions Code to furnish a bond in the sum above named, conditioned as herein set forth.

NOW THEREFORE, if said Principal shall comply with the provisions of the Division 8, Chapter 14 of the

Business and Professions code and all supplementary acts as specified therein, now and hereafter enacted, and if

said Principal shall, while acting as a Tax Preparer, cause no damages to any person by reason of misstatement,

misrepresentation, dishonesty, fraud, deceit, or any unlawful acts or omissions of Principal or its associates or

employees while acting in the scope of their employment or association as Tax Preparers, this obligation shall then

and in that event be void; otherwise it shall remain in full force and effect for the period hereinafter set forth.

This bond is also subject to the following conditions:

________________________________________ Preview

1. That any person who sustains damages covered by this bond may, in addition to any other remedy that he may

have, bring an action in his own name upon this bond for recovery of such damages.

2. That the total aggregate liability of the Surety to any and all persons, regardless of the number of claims against

the bond or the number of years the bond remains in force, shall be limited to the sum of Five Thousand dollars

($5,000.00) for any one Tax Preparer.

3. That the Surety may cancel this bond and be relieved of further liability hereunder by delivering 30 days

written notice to the Principal at his address last known to the Surety, however, such cancellation shall not

affect any liability incurred or accrued hereunder prior to the termination of said 30-day period.

4. That said bond shall remain in full force and effect during the term for which it is issued and for any renewal

thereof, or until said bond is, subject to the provisions of paragraph 3 hereof, cancelled by said Surety.

IN WITNESS WHEREOF the seal and signature of said Principal is hereto affixed, and the corporate seal and

name of the said Surety is hereto affixed and attested by its duly authorized officers at _______________________,

this _________ day of ________________, __________.

________________________________________

Principal Surety

________________________________________ ________________________________________

By Attorney-In-Fact