$10,000 Missouri Notary Bond and Complimentary $10,000 E&O

$30.00

Buy the $30 MO Notary Bond by entering your notary information exactly as it’s listed on your Missouri Notary Public Paperwork. If you are unsure about your name, dates, county, or commission number, contact the Missouri Secretary of State to confirm. Incorrect information may lead to rejection of the notary bond.

The $10k MO Notary Bond is required by law. Complimentary $10k E&O insurance is included with bond purchase. Additional 4-year policies up to $100,000 are quoted below and may be added to the notary bond purchase.

- Description

- MO Notary Bond Content

- MO Notary E&O Content

Description

Missouri Notary Bond

- This $30 Missouri Notary Bond meets the state’s $10,000 requirement, an d ensures compliance with all MO Notary regulations.

- Surety Bonds provide financial protection for the public served by the notary, offering peace of mind during notarial transactions. Notaries will be responsible for reimbursing claims on their notary bond.

- Missouri Notary Errors & Omission (E&O) is available in various coverage amounts to cover a notary in the event of a claim.

- Quick and efficient application process allows for prompt email issuance of Missouri Notary Bonds. Allow up to 1 business day for processing.

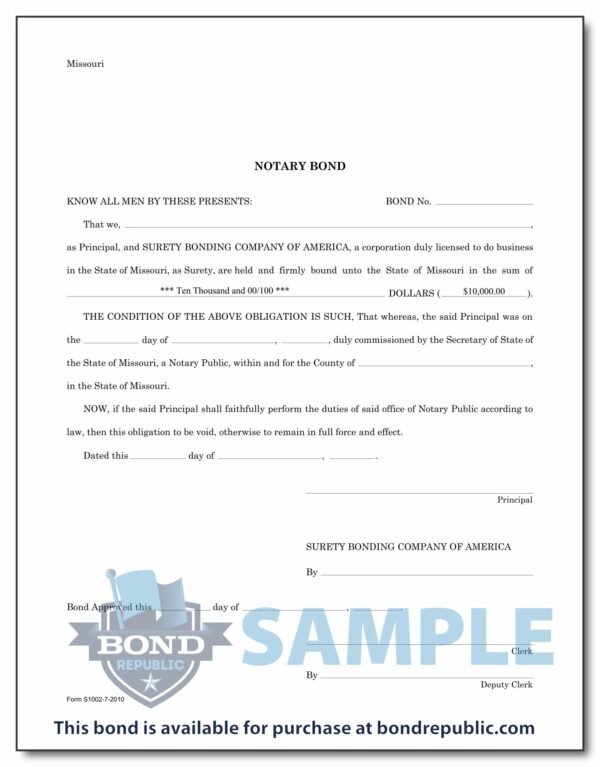

Missouri

NOTARY BOND

KNOW ALL MEN BY THESE PRESENTS: BOND No.

That we, ,

as Principal, and SURETY BONDING COMPANY OF AMERICA, a corporation duly licensed to do business

in the State of Missouri, as Surety, are held and firmly bound unto the State of Missouri in the sum of

*** Ten Thousand and 00/100 *** DOLLARS ( $10,000.00 ).

THE CONDITION OF THE ABOVE OBLIGATION IS SUCH, That whereas, the said Principal was on

the day of , , duly commissioned by the Secretary of State of

the State of Missouri, a Notary Public, within and for the County of ,

in the State of Missouri.

NOW, if the said Principal shall faithfully perform the duties of said office of Notary Public according to

law, then this obligation to be void, otherwise to remain in full force and effect.

Dated this day of , .

Principal

SURETY BONDING COMPANY OF AMERICA

By

Bond Approved this day of , .

Clerk

By

Deputy Clerk

Form S1002-7-2010

—————————————————–

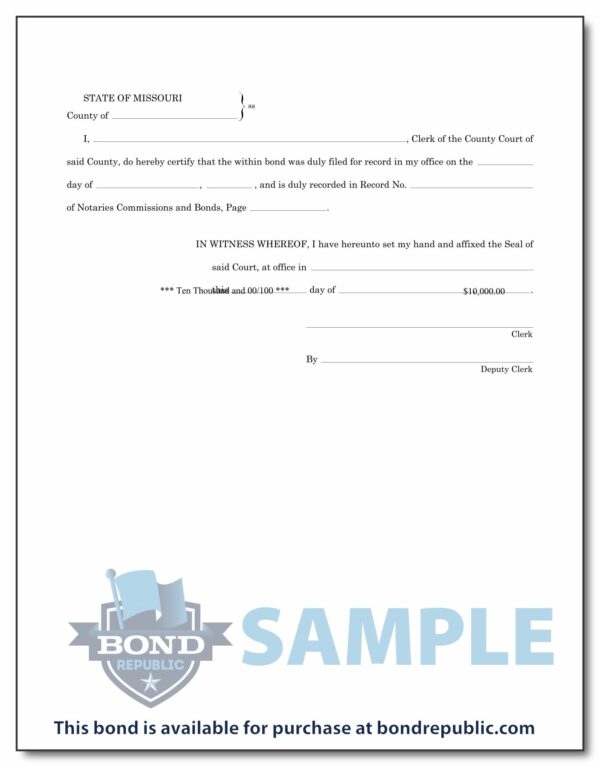

STATE OF MISSOURI

ss

County of

I, , Clerk of the County Court of

said County, do hereby certify that the within bond was duly filed for record in my office on the

day of , , and is duly recorded in Record No.

of Notaries Commissions and Bonds, Page .

IN WITNESS WHEREOF, I have hereunto set my hand and affixed the Seal of

said Court, at office in

this day of , .

Clerk

By

Deputy Clerk

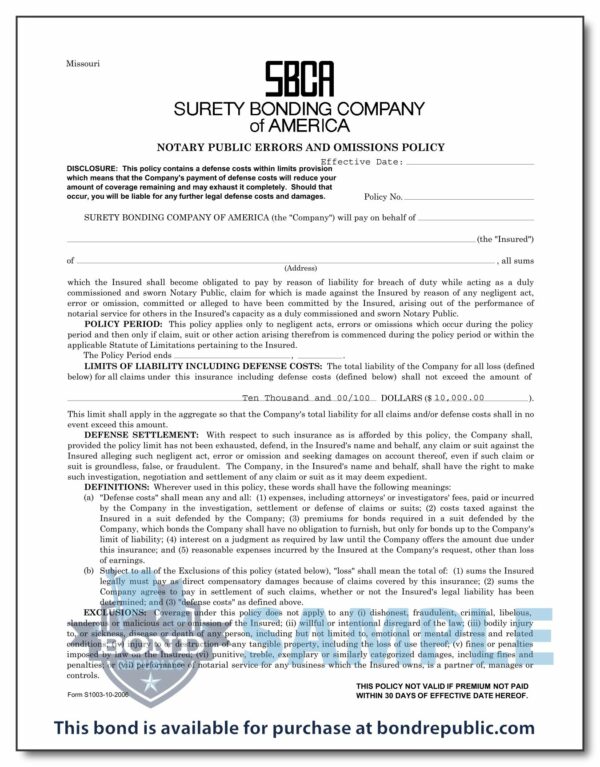

Missouri

NOTARY PUBLIC ERRORS AND OMISSIONS POLICY

Effective Date:

DISCLOSURE: This policy contains a defense costs within limits provision

which means that the Company’s payment of defense costs will reduce your

amount of coverage remaining and may exhaust it completely. Should that

occur, you will be liable for any further legal defense costs and damages. Policy No.

SURETY BONDING COMPANY OF AMERICA (the “Company”) will pay on behalf of

(the “Insured”)

of , all sums

(Address)

which the Insured shall become obligated to pay by reason of liability for breach of duty while acting as a duly

commissioned and sworn Notary Public, claim for which is made against the Insured by reason of any negligent act,

error or omission, committed or alleged to have been committed by the Insured, arising out of the performance of

notarial service for others in the Insured’s capacity as a duly commissioned and sworn Notary Public.

POLICY PERIOD: This policy applies only to negligent acts, errors or omissions which occur during the policy

period and then only if claim, suit or other action arising therefrom is commenced during the policy period or within the

applicable Statute of Limitations pertaining to the Insured.

The Policy Period ends , .

LIMITS OF LIABILITY INCLUDING DEFENSE COSTS: The total liability of the Company for all loss (defined

below) for all claims under this insurance including defense costs (defined below) shall not exceed the amount of

Ten Thousand and 00/100 DOLLARS ($ 10,000.00 ).

This limit shall apply in the aggregate so that the Company’s total liability for all claims and/or defense costs shall in no

event exceed this amount.

DEFENSE SETTLEMENT: With respect to such insurance as is afforded by this policy, the Company shall,

provided the policy limit has not been exhausted, defend, in the Insured’s name and behalf, any claim or suit against the

Insured alleging such negligent act, error or omission and seeking damages on account thereof, even if such claim or

suit is groundless, false, or fraudulent. The Company, in the Insured’s name and behalf, shall have the right to make

such investigation, negotiation and settlement of any claim or suit as it may deem expedient.

DEFINITIONS: Wherever used in this policy, these words shall have the following meanings:

(a) “Defense costs” shall mean any and all: (1) expenses, including attorneys’ or investigators’ fees, paid or incurred

by the Company in the investigation, settlement or defense of claims or suits; (2) costs taxed against the

Insured in a suit defended by the Company; (3) premiums for bonds required in a suit defended by the

Company, which bonds the Company shall have no obligation to furnish, but only for bonds up to the Company’s

limit of liability; (4) interest on a judgment as required by law until the Company offers the amount due under

this insurance; and (5) reasonable expenses incurred by the Insured at the Company’s request, other than loss

of earnings.

(b) Subject to all of the Exclusions of this policy (stated below), “loss” shall mean the total of: (1) sums the Insured

legally must pay as direct compensatory damages because of claims covered by this insurance; (2) sums the

Company agrees to pay in settlement of such claims, whether or not the Insured’s legal liability has been

determined; and (3) “defense costs” as defined above.

EXCLUSIONS: Coverage under this policy does not apply to any (i) dishonest, fraudulent, criminal, libelous,

slanderous or malicious act or omission of the Insured; (ii) willful or intentional disregard of the law; (iii) bodily injury

to, or sickness, disease or death of any person, including but not limited to, emotional or mental distress and related

conditions; (iv) injury to or destruction of any tangible property, including the loss of use thereof; (v) fines or penalties

imposed by law on the Insured; (vi) punitive, treble, exemplary or similarly categorized damages, including fines and

penalties; or (vii) performance of notarial service for any business which the Insured owns, is a partner of, manages or

controls.

THIS POLICY NOT VALID IF PREMIUM NOT PAID

Form S1003-10-2006 WITHIN 30 DAYS OF EFFECTIVE DATE HEREOF.

—————————————————–

OTHER INSURANCE: This insurance is excess over any other applicable insurance whether such insurance is

primary, excess, contributory, contingent, or otherwise and whether such insurance is collectible or not, unless such

other insurance is written to be specifically excess over the insurance provided by this policy.

INSURED’S DUTIES IN THE EVENT OF OCCURRENCE, CLAIM OR SUIT:

(a) Upon knowledge of any occurrence which may reasonably be expected to result in a claim or suit, written notice

containing particulars sufficient to identify the Insured and also reasonably obtainable information with respect

to the time, place and circumstances thereof, and the names and addresses of the potential claimant and of

available witnesses, shall be given by or for the Insured to the Company or any of its authorized agents as soon

as practicable.

(b) If claim is made or suit is brought against the Insured, the Insured shall immediately forward to the Company

every demand, notice, summons or other process received by it or its representative.

(c) The Insured shall cooperate with the Company and, upon the Company’s request, assist in making settlements,

in the conduct of suits and in enforcing any right of contribution or indemnity against any person or

organization who may be liable to the Insured for acts, errors or omissions with respect to which insurance is

afforded under this policy; and the Insured shall attend hearings and trials and assist in securing and giving

evidence and obtaining the attendance of witnesses. The Insured shall not, except at his own cost, voluntarily

make any payment, admit any liability, assume any obligation or incur any expense except with the prior

written consent of the Company.

SUBROGATION: In the event of any payment for any loss under this insurance, the Company shall be subrogated

to all of the Insured’s rights of recovery thereafter against any person or organization and the Insured shall execute and

deliver instruments and papers and do whatever else is necessary to secure such rights to the Company. The Insured

shall do nothing after loss to prejudice such rights.

ASSIGNMENT: This policy shall be void if assigned or transferred without the Company’s written consent.

ACTION AGAINST COMPANY: No action shall lie against the Company unless, as a condition precedent

thereto, there shall have been full compliance with all of the terms of this policy, nor until the amount of the Insured’s

obligation to pay shall have been finally determined either by judgment after actual trial or by written agreement of the

Insured, the claimant, and the Company.

Any person or organization or the legal representative thereof, who is signatory to such judgment or written

agreement, shall thereafter be able to recover under this policy to the extent of the insurance afforded by this policy. No

person or organization shall have any right under this policy to join the Company as a party to any action against the

Insured to determine the Insured’s liability, nor shall the Company be impleaded by the Insured or the Insured’s legal

representative.

MISSOURI PROPERTY AND CASUALTY INSURANCE GUARANTY ASSOCIATION COVERAGE

LIMITATIONS: Subject to the provisions of the Missouri Property and Casualty Insurance Guaranty Association Act

(the “Act”), if the Company is a member of the Missouri Property and Casualty Insurance Guaranty Association (the

“Association”), the Association will pay claims covered under the Act if the Company becomes insolvent. The Act

contains various exclusions, conditions and limitations that govern a claimant’s eligibility to collect payment from the

Association and affect the amount of any payment. The following limitations apply subject to all other provisions of the

Act: (1) Claims covered by the Association do not include a claim by or against an insured of an insolvent insurer, if the

insured has a net worth of more than $25 million on the later of the end of the insured’s most recent fiscal year or the

December thirty-first of the year next preceding the date the insurer becomes an insolvent insurer; provided that an

insured’s net worth on such date shall be deemed to include the aggregate net worth of the insured and all of its

affiliates as calculated on a consolidated basis. (2) Payments made by the Association for covered claims will include

only that amount of each claim which is less than $300,000. However, the Association will not: (1) pay an amount in

excess of the applicable limit of insurance of the policy from which a claim arises; or (2) return to an insured any

unearned premium in excess of $25,000. These limitations have no effect on the coverage the Company will provide

under this policy.

CANCELLATION: This policy may be cancelled by the Company by mailing sixty (60) days’ written notice stating

the reason for cancellation to the Insured and may be cancelled by the Insured by surrender hereof to the Company or

any of its agents or by mailing to the Company sixty (60) days’ written notice and this policy shall be deemed cancelled

and the policy period terminated upon such return or at the expiration of said sixty (60) days. If, however, cancellation

is based upon (1) nonpayment of premium; (2) fraud or material misrepresentation affecting this policy or the

presentation of a claim hereunder or a violation of any of the terms and conditions of this policy; (3) changes in

conditions after the effective date of this policy which have materially increased the hazards originally insured; (4)

insolvency of the Company; or (5) the Company involuntarily loses reinsurance for this policy, the Company may cancel

this policy upon at least ten (10) days’ written notice stating the reason for cancellation to the Insured before the

effective date of cancellation. The time of surrender or the effective date and hour of cancellation stated in the notice

shall become the end of the policy period.

If the Insured cancels, the premium shall be fully earned. If the Company cancels, earned premium shall be

computed pro rata. A premium adjustment may be made either at the time cancellation is effected or as otherwise

permitted by law, but payment of unearned premium is not a condition of cancellation.

Dated, signed and sealed this day of , .

Address claims to: SURETY BONDING COMPANY OF AMERICA

Surety Bonding Company of America

P. O. Box 5111 By

Sioux Falls, SD 57117-5111

—————————————————–

Missouri

NOTARY PUBLIC ERRORS AND OMISSIONS POLICY

POLICY CHANGE DISCLOSURE

Thank you for purchasing your Notary Public Errors and Omissions Policy from Surety Bonding

Company of America. We are pleased to enclose your policy for the current policy term.

Please read your policy carefully. The attached policy now contains a defense costs

within limits provision which means that the Company’s payment of defense costs will

reduce your amount of coverage remaining and may exhaust it completely. Should that

occur, you will be liable for any further legal defense costs and damages. Further other

changes have expanded the EXCLUSIONS section, restated OTHER INSURANCE

(formerly Co-Insurance), and added four new sections captioned SUBROGATION,

ASSIGNMENT, ACTION AGAINST COMPANY, and MISSOURI PROPERTY AND

CASUALTY INSURANCE GUARANTY ASSOCIATION COVERAGE LIMITATIONS.

Please understand that policies issued on the new form, S1003-10-2006 contain “defense costs”

(defined in the new form) within the stated Limit of Liability, whereas the previous policy form

provided for payment of similar expenses in an amount up to one-half of the policy limit, in addition

to the Limit of Liability. If you had a policy with us on any form other than S1003-10-2006, this

provision changes the coverage from any policy that you may have had previously.

If you have any questions, contact your agent or call 1-800-331-6053 to speak with a Company

representative.

P.O. Box 5077

Sioux Falls, SD 57117-5077

Phone: 1-800-331-6053

FAX: 1-605-335-0357

Surety Bonding Company of America is a subsidiary of CNA Surety.

—————————————————–